Group Health Insurance, Employee Benefits, Employee Benefits Package, Employee Sponsored Benefits and Colorado Insurance Broker In Greeley, Loveland, Fort Collins, Windsor, Longmont, CO, and the Surrounding Areas

Group Health Insurance and Employee Benefits Packages from Volk

Volk Insurance Benefits offers cutting-edge solutions to medical insurance, including employee and employer-sponsored benefits packages.

Our objective is to work with employers to implement the best benefits packages to meet your strategic business goals. Many employers offer group health insurance coverage because ultimately, an attractive benefits package helps employers appeal to top employees and retain them. An employer’s benefits package usually offers medical insurance and may include ancillary coverages such as dental, vision, life, short term disability, and long term disability. Our experienced team serves both individuals and businesses in Fort Collins, Loveland, Greeley, Longmont, Windsor, CO, and the surrounding areas.

What is Group Health Insurance?

What is Group Health Insurance?

A group health insurance plan is a key component of many employee benefits packages that employers provide for employees. The majority of Americans have group health insurance coverage through their employer or the employer of a family member. One of the advantages for employees in a group health plan is the contribution most employers make toward the cost of the health coverage premium – in many cases, employers pay the monthly premium or a portion of the monthly premium for an employee. Another advantage is that most employers have established Premium Only Plans (POP plans) that allow employees to pay any employee-required contributions to premiums on a pre-tax basis. Between the employer contributions, which aren’t taxable for employees, and the POP plan, employer-provided health insurance is significantly subsidized due to these tax breaks.

The tiers are based on the percentage the plan pays of the average overall cost of providing essential health benefits to members:

- Platinum plans are the most generous and more expensive. These are designed to pay as much as 90% of medical expenses

- Gold plans are designed to pay 80% of medical expenses

- Silver plans are expected to pay 70% of medical expenses

- Bronze plans are expected to pay 60% of medical expenses.

These percentages are not the same as coinsurance, which calls for an individual to pay a specific percentage of the cost of a specific service.

There are other myriad requirements that apply to group health in addition to those required by the ACA. There are laws that address benefit communications (ERISA), claims appeals (ERISA) and portability of coverage (HIPAA) among others.

Both the ACA and the federal HIPAA law mandate that no matter what pre-existing health conditions small employer group members may have, no small employer or an individual employee can be turned down by an insurance company for group coverage. This requirement is known in the insurance industry as “guaranteed issue.” In addition, each insurance company must renew its small employer health plan contracts every year, at the employer’s discretion, unless there is non-payment of premium, the employer has committed fraud or intentional misrepresentation, or the employer has not complied with the terms of the health insurance contract.

REQUEST A QUOTEHave You Explored Group Health Insurance?

Employers that provide group health insurance cover the medical needs of most Americans and their dependents. Plans ensure individual employees and their families (for a premium). It may include children up to 26 years old.

The team at Volk Insurance Benefits helps businesses understand their options for coverage and fulfill any legal obligations, as well as making it possible for them to optimize their employee benefits arsenal.

- Easier Employee Benefits

Businesses can benefit from the American Rescue Plan Act, but this may involve time-consuming paperwork. The same can be said for the regulations surrounding the Employee Retirement Income Security Act (ERISA) and the Affordable Care Act (ACA). In both cases, our assistance proves invaluable to our Northern Colorado customers. - An Attractive Employee Benefits Package

Employee health is essential to any company that wants to perform at its highest potential. An excellent employee benefits package is also an important recruitment and retention tool. Our exclusive broker status with top insurance companies enables us to create group insurance packages that take advantage of special terms—ask us how we can apply these packages to your small business as well. - Flexible Employee-Sponsored Benefits

Individual health insurance is expensive, and taking a job with employee benefits is essential for many Americans. Many employers create POP plans that offer added tax benefits to the employee. Volk Insurance Benefits also advises businesses on how to optimize their employee benefits and offer flexible employee-sponsored options.

Employee Census

Employee Census

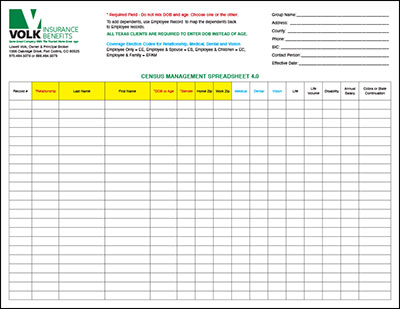

To begin, please download the Employee Census Form using the DOWNLOAD CENSUS FORM link below. Once you have downloaded the form to your computer, open the PDF file using Adobe Reader. If you do not have Adobe Reader you can download it for free using this link GET ADOBE READER. Fill out the form fields as needed and then save the file to your computer using a new file name; example “Your Company Name” Census Form.pdf.

After you have finished filling out the form and saving it, return to our website contact page, click on the UPLOAD button. Attach the form you saved to your computer and send us your email.

Download Census Form Group Insurance That Protects Profits

Group Insurance That Protects Profits

The experts at Volk Insurance Benefits also help small business owners find ways to save.

It might be affordable benefits packages to employees or other incentives that keep the workforce healthy and the work environment attractive to new talent.

Small Business Health Insurance

Businesses with less than fifty employees are not government-mandated to offer health insurance benefits, but the benefits make good business sense. Rule changes under Federal HIPAA law and the Affordable Care Act have meant that insurance companies now offer small businesses the opportunity to participate in cost-saving group coverage schemes, and that’s excellent news for local enterprises.

Learn MoreCOBRA Group Health Benefits and Medicare Insurance

Volk Insurance Benefits can also assist in the administration of the Consolidated Omnibus Budget Reconciliation Act (COBRA) benefits. It ensures continued individual health insurance to those who leave the company’s employment. Our specialist can also help employees understand their options as they move into Medicare insurance eligibility.

Contact Our Experienced Colorado Insurance Broker Today

Group and employee benefits are complicated but essential. The specialists at Volk Insurance Benefits are happy to help businesses with solutions that keep employees healthy and remain within budget. Call us today for more information.